Securing Retirement Benefits For India's Unorganised Sector

APY is open for 18-40 years age-group bank account holders, who are not IT payers

Securing Retirement Benefits For India's Unorganised Sector

It has emerged as a cornerstone of India’s social security ecosystem, especially for its vast unorganised workforce. The government’s continued focus on digital integration, women participation, and rural outreach has helped broaden APY’s footprint across India

As a measure of addressing the twin challenges of longevity risks and lack of retirement security among the country’s vast unorganised workforce, the Union Government launched the Atal Pension Yojana (APY) on May 9, 2015, which became operational a few days later on June 1. The scheme was designed to encourage voluntary savings for retirement by offering defined pension benefits, linked to the age of joining and amount of contribution.

Targeted primarily at poor and underprivileged workers in the informal sector, the scheme has emerged as one of the most inclusive and accessible social security initiatives in India.

APY was launched to create a universal social security system for all Indians, especially the poor, the underprivileged and the workers in the unorganised sector. It is an initiative that endeavours to provide financial security and cover future exigencies for the people in the unorganised sector.

The scheme is open to all bank account holders in the age group of 18 to 40 years, who are not income taxpayers. The contributions differ as they are based on the pension amount chosen. Subscribers would receive the guaranteed minimum monthly pension of anything between Rs. 1000 and Rs. 5000 after the age of 60 years, based on the contributions and the pension slab chosen by the subscriber at the time of joining the scheme.

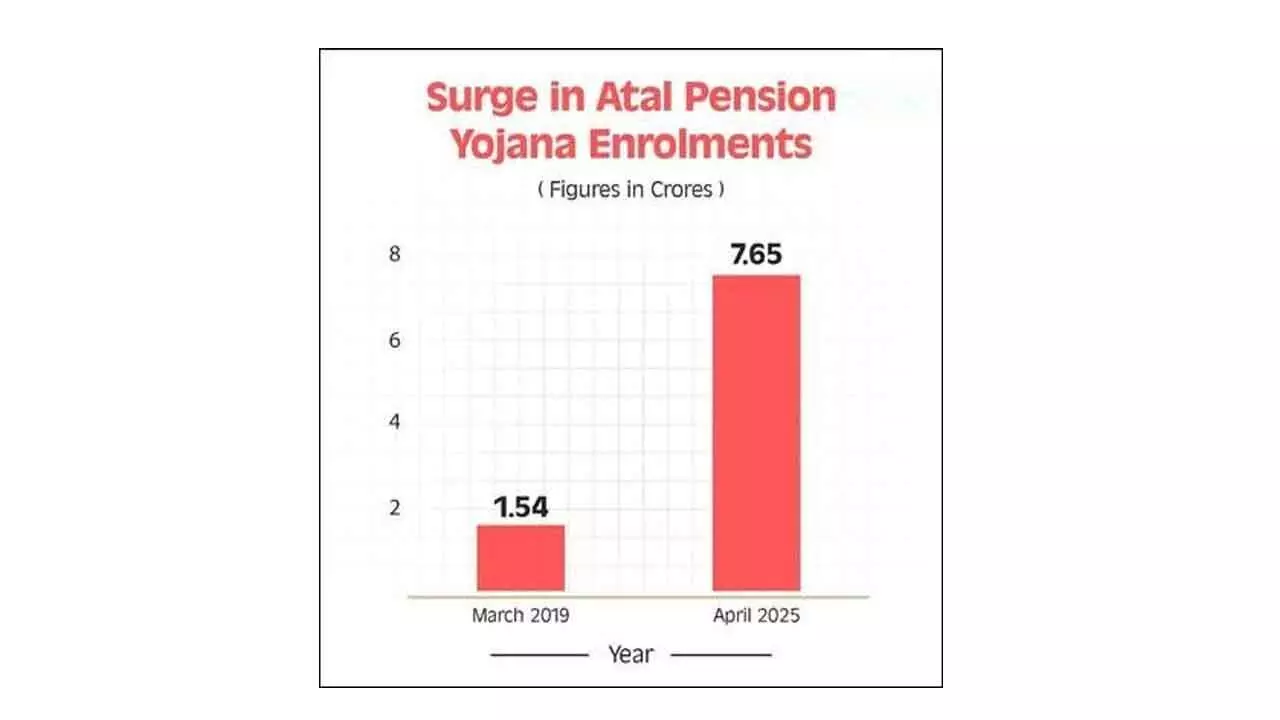

As of April 2025, APY has accumulated over 7.65 crore subscribers, mobilised a total corpus of Rs 45,974.67 crore, and recorded increasing participation from women, who now comprise about 48% of all subscribers.

It is aimed at workers in the unorganised sector, who often lack formal pension coverage. It is initially available to all citizens of India between 18 and 40 years of age. With effect from October 1, 2022, individuals paying income tax are not eligible to join the scheme.

The minimum contribution period is 20 years, depending on the age of joining. Monthly contribution varies and depends on factors like the age at the time of enrolment and the desired pension amount. For eligible subscribers who joined between June 1, 2015 and March 31, 2016 (The scheme continues but without government co-contribution), the government co-contributed 50 per cent of the total contribution or Rs 1,000 per annum (whichever is lower) for five years. This applied only to subscribers not covered under any statutory social security scheme and not income taxpayers at the time.

It is administered by the Pension Fund Regulatory and Development Authority (PFRDA) and managed under the National Pension System (NPS) architecture.

Exit and Withdrawal Options are as follows: Exit at age 60: Full pension begins; Exit before age 60: Permitted only in cases of death or terminal illness; Voluntary Exit: Allowed, but the subscriber only receives the contribution made (with interest) and government co-contribution (if any) is forfeited.

Procedure for opening account:

Approach the bank branch/post office where individual's savings bank account is held or open a savings account if the subscriber doesn't have one. Provide the bank A/c number or post office savings bank account number; fill the APY registration form, while also providing Aadhaar and mobile number details. This is not mandatory, but may be provided to facilitate the communication regarding contribution. Ensure keeping the required balance in the savings bank account/post office savings bank account for transfer of monthly/quarterly/half yearly contribution.

The benefit of minimum pension under Atal Pension Yojana would be guaranteed by the government in the sense that if the actual realised returns on the pension contributions are less than the assumed returns for minimum guaranteed pension, over the period of contribution, such shortfall shall be funded by the government. On the other hand, if the actual returns on the pension contributions are higher than the assumed returns for minimum guaranteed pension, over the period of contribution, such excess shall be credited to the subscriber’s account, resulting in enhanced scheme benefits to the subscribers.

The Atal Pension Yojana has emerged as a cornerstone of India’s social security ecosystem, especially for its vast unorganised workforce. With nearly 7.65 crore subscribers and a steadily growing pension corpus, the scheme not only ensures financial independence for the elderly but also promotes long-term savings culture among low-income households. The government’s continued focus on digital integration, women participation, and rural outreach has helped broaden APY’s footprint across India. With women making up over 55 per cent of new subscribers in FY 2024–25 and a significant surge in overall enrolments during the same period, the Atal Pension Yojana is steadily progressing toward its vision of ‘Pension for All’. (PIB)